December 22, 2023

2021-2030 Webuild S.p.A. warrants isin it0005454423 (“Anti-Dilutive Warrants”)

Communication as per Article 3.7(a) of the Regulation of the Anti-Dilutive Warrants

Milan, December 22, 2023 - As disclosed in the notice issued today pursuant to art. 85-bis of Consob Issuers’ Regulation, on December 21, 2023, the Company issued 449,116 ordinary Webuild S.p.A. shares (the “2023 issue”) to the unscheduled creditors (as defined in the proposed partial proportionate demerger of Astaldi S.p.A. to Webuild S.p.A. and as resolved by its shareholders in their extraordinary meeting of 30 April 2021).

As a result of the 2023 issue and those communicated on 31 March 2022 and 1 June 2022 (the “2022 issues”, all the issues jointly defined as the “subsequent issues”), at present, the following may be exercised:

- up to a maximum of 4,756,063 anti-dilutive warrants (of which 751,865 already exercised and settled at 10 September 2023),

- equal to 5.8907042% of the anti-dilutive warrants held by each holder (“% exercisable warrants”),

- giving the right to receive a maximum of 4,756,063 ordinary Webuild S.p.A. exchange shares (of which 751,865 ordinary Webuild S.p.A. shares already assigned on 10 September 2023) (“exchange shares”).

Calculation method of the exercisable anti-dilutive warrants

The following formula can be used to calculate the anti-dilutive warrants that can be exercised based on the subsequent issues described above:

Exercisable warrants = [(Originally assigned warrants + purchased warrants – sold warrants) * % exercisable warrants] – already exercised warrants

Only whole numbers of anti-dilutive warrants (rounded down to the nearest unit) can be exercised.

Any fractions will therefore contribute to the exercise of the anti-dilutive warrants upon the occurrence of any additional subsequent issues, to be communicated by the company from time to time, which will be consolidated with the previous ones, for the part not exercised.

An automatic calculator is available in the “Investor Relations/Shareholders and Share Capital/Warrants – Documents and Communications” section to facilitate the above calculation.

Deadline for the exercise of the anti-dilutive warrants

The anti-dilutive warrants may be exercised by their holders at any time before 31 August 2030. The warrants not exercised before the final deadline of 31 August 2030 shall be forfeited and become invalid to all effects.

Exercise method for the anti-dilutive warrants

Each holder of anti-dilutive warrants that intends to exercise them shall:

- download, complete and sign the exercise notice available in the “Investor Relations/Shareholders and Share capital/Warrants - Documents and Communications” section (“”);

- send the exercise notice to the intermediary with which it has a safe custody account holding the anti-dilutive warrants (the “custodian intermediary”).

Upon receipt of the above, the custodian intermediary shall:

- check the data are complete and attest, by signing the form, that the requesting party is the owner of the anti-dilutive warrants. By signing the exercise notice, the custodian intermediary also authorises Euronext Securities Milan S.p.A. (Monte Titoli) to operate on its behalf, terminating the exercised anti-dilutive warrants and crediting the related shares, without any need for additional confirmation;

- send the exercise notice to the certified email addresses pec@pec.webuildgroup.com and corporateactions@pec.spafid.it;

in accordance with the Service Rules for intermediaries to which reference is made.

Only exercise notices that are complete and correct and sent by the relevant custodian intermediary can be considered and duly processed. Exercise notices received after noon are considered the next business day.

Antidilutive Warrants exercise

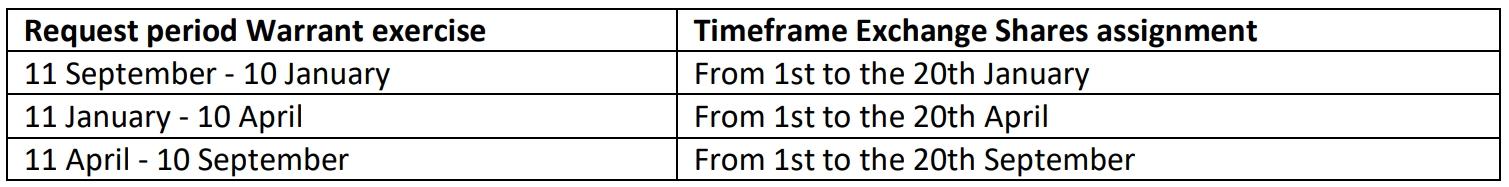

The Exchange Shares will be assigned during the following timeframes (save as otherwise provided for by the Antidilutive Warrant Regulation):

****

More information is available in the documents on the anti-dilutive warrants in the ”Investor Relations/Shareholders and Share capital/Warrants – Documents and communications” section of the website www.webuildgroup.com.

The “originally attributed warrants” are the anti-dilutive warrants assigned to holders of ordinary Webuild shares at 31 July 2021 as the open market day before the effective date of the partial proportionate demerger of Astaldi S.p.A. to Webuild S.p.A. (the “assignment date”).

The “purchased warrants” are any anti-dilutive warrants purchased after the assignment date.

The “sold warrants” are any anti-dilutive warrants sold after the assignment date.

The “exercised warrants” are any anti-dilutive warrants exercised at previous subsequent issues.